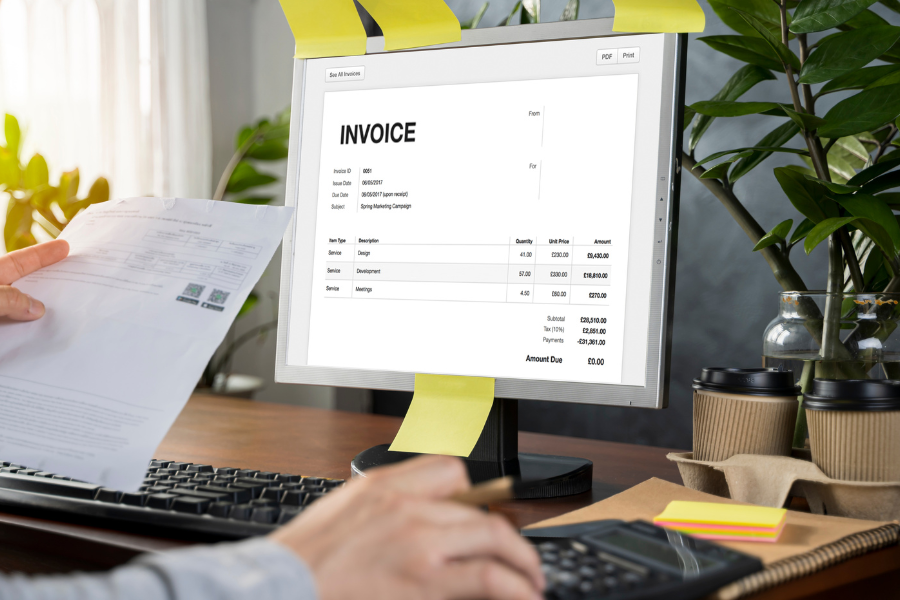

Decoding Malaysia’s Updated MyInvois E-Invoicing Guidelines for Businesses

Malaysia’s journey toward digital transformation has taken a significant leap with the implementation of updated MyInvois e-invoicing guidelines. These changes, spearheaded by the Inland Revenue Board of Malaysia (IRBM), aim to streamline tax compliance, enhance transparency, and foster a more efficient business ecosystem. This blog unpacks the details of these updated guidelines, offering businesses a […]