Structuring e-Invoice Workflows for Multi-Tenant Property Management

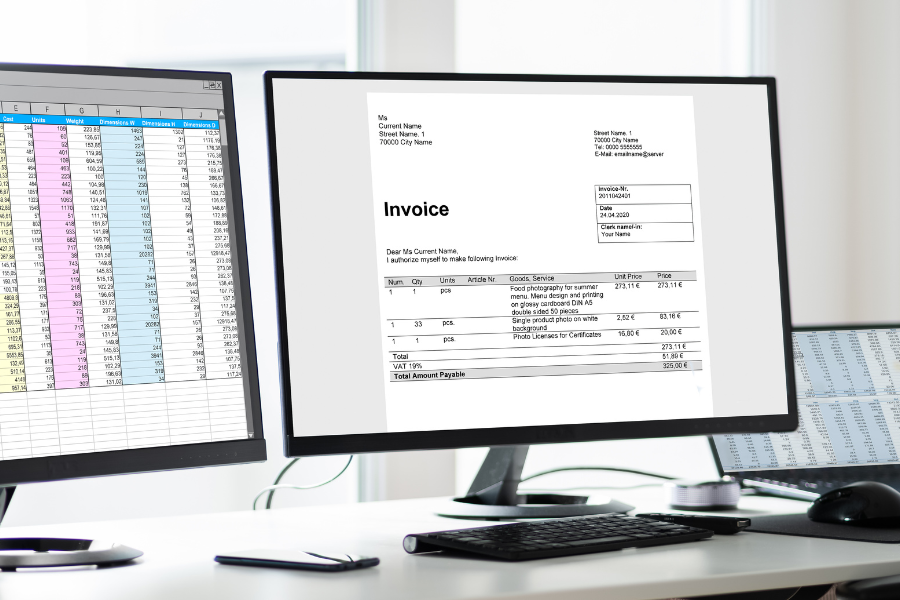

Handling invoices for multi-tenant properties is quite multifaceted. From tenants to service vendors and regulatory bodies, property managers have to deal with a lot, which makes e-invoicing vital for compliance, accuracy, and efficiency. Having a defined workflow helps in the smooth processing of transactions, minimizing manual errors, and quickening the pace of financial processes. This […]